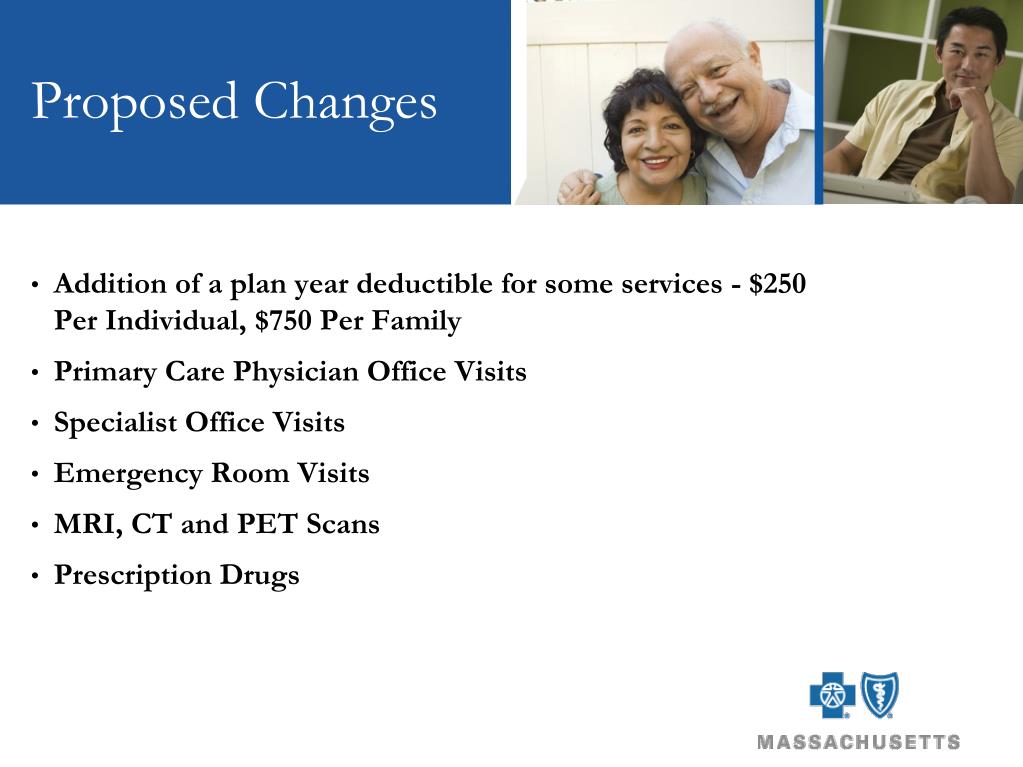

**This Blue Cross Blue Shield Swift Move Could Slash Your Benefits Right Away — Here’s What You Need to Know** In a time when healthcare costs continue rising and Americans are increasingly aware of insurance complexities, whispers are spreading about a bold shift from Blue Cross Blue Shield plans that could significantly reduce out-of-pocket expenses—sometimes cutting benefits immediately. What once felt like a distant possibility is now on many radar screens, sparking curiosity and concern alike. This movement isn’t just a trend—it’s a response to a shifting landscape in health coverage, cost transparency, and plan design. ### Why This Blue Cross Blue Shield Swift Move Could Slash Your Benefits Right Away Rising healthcare inflation, maze-like insurance plans, and growing consumer demand for clear, upfront pricing have placed pressure on insurers to reevaluate coverage structures. Recent changes in Blue Cross Blue Shield plans across several states reflect efforts to streamline benefits while managing costs, sometimes through adjusted co-pays, narrower networks, or revised coverage tiers. These adjustments can lead to faster changes in patient benefits—sometimes without the full notice users expect—making awareness essential. ### How This Blue Cross Blue Shield Swift Move Could Slash Your Benefits Right Away Actually Works

### Common Questions About This Blue Cross Blue Shield Swift Move Could Slash Your Benefits Right Away **Q: What exactly changes when my Blue Cross Blue Shield plan shifts?** A: Key adjustments often include higher copays, narrower provider access, or reevaluated in-network tiers—changes designed to lower average costs but may affect out-of-pocket expenses immediately. **Q: Am I being penalized or excluded from care because of this change?** A: Most changes are part of broader plan redesigns meant to sustain coverage across member groups, not exclusions. Benefits shifts are transparent in your plan summary. **Q: Can this affect my existing treatments or prescription coverage?** A: Changes primarily impact cost structure, not clinical coverage—most essential services remain covered, but cost-sharing may vary. **Q: How do I know if this move affects me?** A: Check your plan’s updated Summary of Benefits and Coverage, usually available via your member portal or customer service. ### Opportunities and Considerations **Pros:** - Lower average out-of-pocket costs for routine care - Greater transparency in how coverage works - More control through plan comparison tools **Cons:** - Potential disruptions in provider access - Need to adapt financial planning for unexpected costs - Less predictable short-term coverage experience Balancing these factors helps users navigate changes without unnecessary anxiety. ### What This Blue Cross Blue Shield Swift Move Could Slash Your Benefits Right Away May Be Relevant For Individuals managing chronic conditions, frequent users of outpatient services, and patients seeking predictable monthly healthcare expenses may see tangible relief. Small business owners and freelancers navigating insurance often benefit most from clearer cost structures—yet all users should assess how these changes fit within their long-term financial health goals. ### Soft Call to Action Understanding how this swift move impacts your benefits empowers smarter, informed decisions. Stay curious, verify your plan details, and use available tools to map coverage to your needs—no urgency, just clarity. Knowledge helps you navigate change with confidence. --- This Blue Cross Blue Shield Swift Move Could Slash Your Benefits Right Away reflects a broader shift toward cost transparency and adaptive coverage in a dynamic U.S. healthcare environment. By staying informed and proactive, readers can adapt their health strategies with clarity and control—turning uncertainty into opportunity.

Individuals managing chronic conditions, frequent users of outpatient services, and patients seeking predictable monthly healthcare expenses may see tangible relief. Small business owners and freelancers navigating insurance often benefit most from clearer cost structures—yet all users should assess how these changes fit within their long-term financial health goals. ### Soft Call to Action Understanding how this swift move impacts your benefits empowers smarter, informed decisions. Stay curious, verify your plan details, and use available tools to map coverage to your needs—no urgency, just clarity. Knowledge helps you navigate change with confidence. --- This Blue Cross Blue Shield Swift Move Could Slash Your Benefits Right Away reflects a broader shift toward cost transparency and adaptive coverage in a dynamic U.S. healthcare environment. By staying informed and proactive, readers can adapt their health strategies with clarity and control—turning uncertainty into opportunity.

Don’t Waste a Second – Convert YouTube Audio to MP3 Fast

The Shocking Truth About Yeps No One Wants to Hear