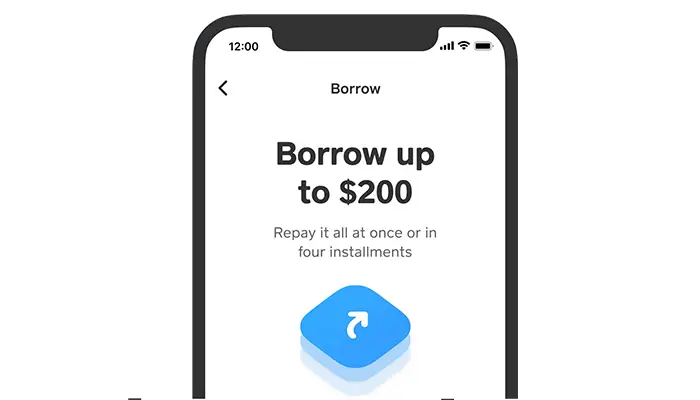

**Why Cash App Borrow Is Reshaping How Americans View Peer-to-Peer Lending** In a digital landscape where financial tools evolve faster than regulations, Cash App Borrow is quietly becoming a go-to solution for cash flow flexibility across the U.S. As everyday users seek smarter ways to borrow and lend without traditional banks, this feature highlights a shift toward instant, mobile-first financial access. With economic uncertainty influencing spending habits, readers are turning to familiar platforms—like Cash App—for faster alternatives that align with their dynamic lifestyles. **Why Cash App Borrow Is Gaining Traction in the U.S.** Financial stress and unpredictable income push many toward tools that feel intuitive and immediate. Cash App Borrow fits this moment, offering a seamless borrowing experience built into a widely used app. With rising cost-of-living pressures, users are increasingly curious about how peer-to-peer lending can provide timely access to funds without lengthy paperwork or rigid credit checks. The ease of starting, repaying, and managing small loans through a mobile interface drives uptake, especially among younger, tech-savvy Americans. This trend reflects a broader cultural shift: convenience and control matter more than ever when managing finances. **How Cash App Borrow Actually Works**

**Common Questions People Have About Cash App Borrow** **1. How fast is borrowing through Cash App?** Most users receive funds within minutes to a few hours, depending on repayment schedule and account setup. Loan approvals are automated and invisible to credit bureaus in some cases, accelerating access. **2. What’s the interest rate, and how is it calculated?** Rates vary by borrow amount and repayment term, typically ranging from 5% to 25% APR. These reflect risk-sharing within Cash App’s borrowing pool and change dynamically with usage. **3. Can I borrow without a traditional credit check?** Yes—Cash App Borrow often assesses risk through existing transaction history and behavioral data, not background credit scores, making it accessible to users with limited or no credit history. **Understanding Risk and Responsibility** While Cash App Borrow offers convenience, responsible use is essential. Unlike conventional loans, fees, variable rates, and repayment timelines can impact financial well-being. Users should weigh their borrowing needs carefully—considering income stability, repayment capacity, and long-term goals. Transparency from the platform about costs and expectations helps foster trust and informed decisions. **Who Benefits Most from Cash App Borrow?** - **Side-income earners needing quick cash between projects** - **Short-term gaps from unexpected expenses** - **Users who value mobile ease over bank account intricacies** - **Newcomers to digital lending seeking accessible alternatives** This tool doesn’t replace formal credit but fills a niche where speed and simplicity matter most—especially in uncertain times. **Common Misconceptions About Cash App Borrow** Many assume borrowing on Cash App is like traditional payday lending—high-cost and risky. In reality, usage is structured around shorter repayment cycles, fixed, disclosed rates, and resources aimed at educating users before, during, and after borrowing. Misinformation fuels fear, but clarity around terms and platform safeguards builds confidence. Always read agreement terms, understand repayment schedules, and avoid overextending credit to prevent financial strain. **Final Thoughts: Navigate Cash App Borrow with Confidence** Cash App Borrow reflects a growing demand for flexible, accessible financial tools in everyday life. Its mobile-first design and smart automation empower users to manage funds when and where they need them—aligning with how modern Americans balance work, income, and uncertainty. While not a universal solution, it offers a pragmatic option when used thoughtfully. Stay informed, borrow with intention, and treat financial technology as a tool—not a shortcut. With awareness and discipline, Cash App Borrow can support real financial moments without compromising long-term stability.

Many assume borrowing on Cash App is like traditional payday lending—high-cost and risky. In reality, usage is structured around shorter repayment cycles, fixed, disclosed rates, and resources aimed at educating users before, during, and after borrowing. Misinformation fuels fear, but clarity around terms and platform safeguards builds confidence. Always read agreement terms, understand repayment schedules, and avoid overextending credit to prevent financial strain. **Final Thoughts: Navigate Cash App Borrow with Confidence** Cash App Borrow reflects a growing demand for flexible, accessible financial tools in everyday life. Its mobile-first design and smart automation empower users to manage funds when and where they need them—aligning with how modern Americans balance work, income, and uncertainty. While not a universal solution, it offers a pragmatic option when used thoughtfully. Stay informed, borrow with intention, and treat financial technology as a tool—not a shortcut. With awareness and discipline, Cash App Borrow can support real financial moments without compromising long-term stability.

You Won’t Believe What Happened at Ztrip—It’s Shocking Beyond Words

What This Locked Image Reveals From Yandex’s Deepest Archives

Yahoo Taiwan Reveals Shocking Secrets No One Was Supposed to See